A safer, more secure and private way to pay with iPhone and Apple Watch

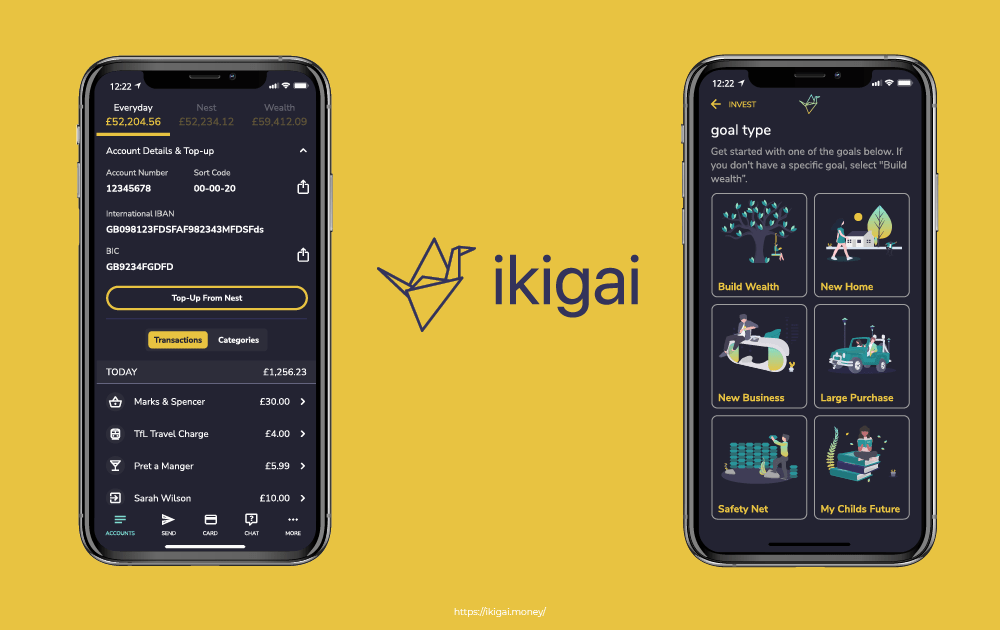

London – 6th July, 2021 — ikigai, the first UK app to bring together everyday banking and wealth management, today brings its customers Apple Pay, a safer, more secure and private way to pay that helps customers avoid handing their payment card to someone else, touching physical buttons or exchanging cash — and uses the power of iPhone to protect every transaction.

Customers simply hold their iPhone or Apple Watch near a payment terminal to make a contactless payment. Every Apple Pay purchase is secure because it is authenticated with Face ID, Touch ID, or device passcode, as well as a one-time unique dynamic security code. Apple Pay is accepted in grocery stores, pharmacies, taxis, restaurants, coffee shops, retail stores, and many more places.

Customers can also use Apple Pay on iPhone, iPad, and Mac to make faster and more convenient purchases in apps or on the web in Safari without having to create accounts or repeatedly type in shipping and billing information. Apple Pay makes it easier to pay for food and grocery deliveries, online shopping, transportation, and parking, among other things. Apple Pay can also be used to make payments in apps on Apple Watch.

Security and privacy are at the core of Apple Pay. When customers use a credit or debit card with Apple Pay, the actual card numbers are not stored on the device, nor on Apple servers. Instead, a unique Device Account Number is assigned, encrypted, and securely stored in the Secure Element, an industry-standard, certified chip designed to store the payment information safely on the device.

Apple Pay is easy to set up. On iPhone, simply open the Wallet app, tap +, and follow the steps to add ikigai’s Visa debit card. Once a customer adds a card to iPhone, Apple Watch, iPad, and Mac, they can start using Apple Pay on that device right away. Customers will continue to receive all of the rewards and benefits offered by ikigai’s cards.

For more information on Apple Pay, visit: http://www.apple.com/apple-pay/ For more information on ikigai, please visit http://ikigai.money/

Media Contacts

Cristina Duta, Marketing Manager

cristina@ikigai.money / hello@ikigai.money

Open Banking Excellence (OBE)

Becci Furnell, Global Press Office

becci@openbankingexcellence.org

Find out more about our crowdfunding campaign at crowdcube.com/ikigai

You can find ikigai in the App Store here

About ikigai

ikigai is a new premium fintech putting self-care at the heart of personal finance. Uniquely combining wealth management with everyday banking, we empower clients to spend well, save well, and invest well – all from the same app. Distinctively and elegantly designed at every touch point – from app to site to ikigai Visa Debit Card – and with a flat-fee subscription model that is fair and transparent, we provide a holistic approach to your finances. When investing, capital is at risk and the value of investments may go down as well as up.

We’re not copying traditional banks, nor other challenger fintechs. We’ve learnt from them – working with best-in-class technology partners to provide a best-in-class service that truly puts the client at the heart of everything we do. ikigai has already received £2 million in seed investment and raised a further £1.8 million via Crowdcube.

We are an electronic money institution, authorised to handle money, facilitate business transactions and currency exchanges. We do not offer certain financial protections, such as the FSCS deposit guarantee. All money held in our current and saving accounts are safely in a segregated and safeguarded account at the Bank of England. All investments are held by WealthKernel, a UK based custodian, regulated by the FCA. As such client investments are eligible for compensation for up to £85,000 by the FSCS.

The Card is issued by UAB PayrNet pursuant to license from Visa. UAB PayrNet is authorised by the Bank of Lithuania under the Law on Electronic Money and Electronic Money Institutions (ref LB001994) for the issuing of electronic money and provision of the related payment services.